Physical vs. digital document verification: is there a right answer?

Document verification has assumed an entirely different dimension in today’s world. The dawn of the digital era has altered our lives radically. Digitalization has transformed the way we live, socialize and conduct our business, in a highly interconnected world. Bulk of people’s time is spent online – be it for work or fun, opening up a myriad of possibilities, but at the same increasing vulnerabilities and frauds. As per a recent finding by Crowe UK in collaboration with University of Portsmouth, frauds cost global economy trillions of dollars every year, standing at about US$5.38 trillion in 2021. Document frauds, no doubt, will be at the top of the table owing to its pervasive nature cutting across social and economic spheres.

Traditionally, verification of documents used to happen physically and was a paper-based data-centric process. While it helped establishing if customers are present at the time of verification, it was not effective in determining if the supporting identity documents are genuine and valid. This apart, the physical documentation verification process suffers from other limitations like being slow, inaccurate, not customer-friendly and importantly – prone to frauds.

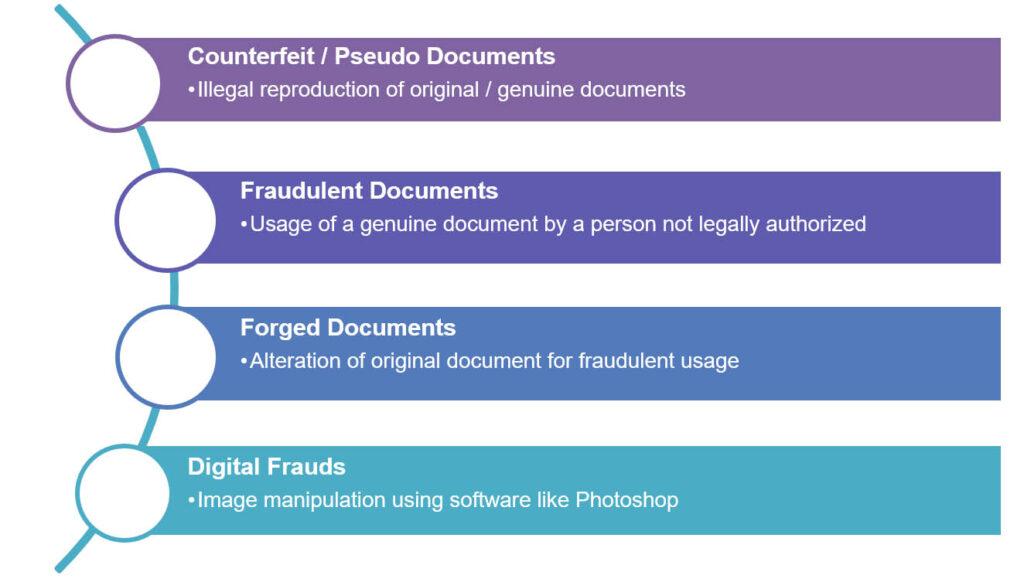

Document frauds have, unfortunately, seeped in to the digital space as well. Fraudsters and counterfeiters have started leveraging on modern technology to perpetuate financial frauds. Some of the common types of document frauds include:

Banking on smarter technologies like AI and ML, the process of digital verification of customer identities and supporting documents has evolved leaps and bounds over the past few years. This has enabled both the regulators and the businesses to ride ahead of fraudsters, prevent crimes and cut losses.

Louis Freeh, former director of the FBI, famously said, “The fraudster’s greatest liability is the certainty that the fraud is too clever to be detected”. Physical document verification is passé, and going digital is certainly the way ahead, considering increased online adoption and to beat fraudsters / impersonators in their own game.

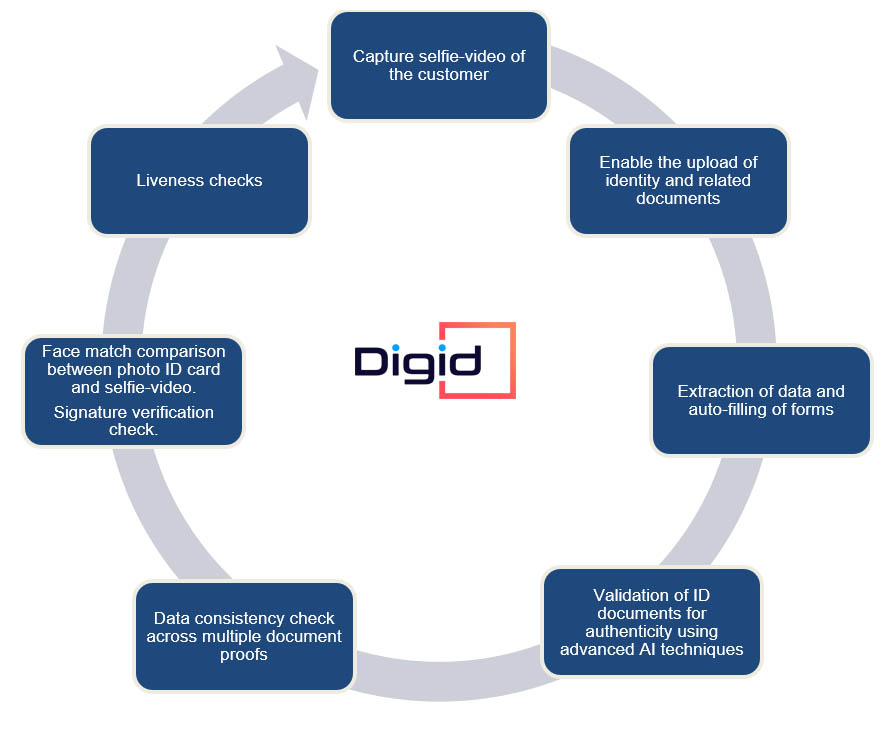

Buoyed by emergent technologies that offer robust security and fraud detection features, digital document verification tools like Digid are redefining the way document verification is done, and this is how:

Digid, built on AI/ML-powered technology, helps businesses in secure verification of digital documents. Any anomaly, impersonation, forgery or tampering is detected in a quicker and efficient manner, thereby enabling businesses to lower risks and reduce losses. Digid offers all of this seamlessly, without compromising on customer comfort and experience.

Come, partner with us for the future of secure on-boarding!

FEEL FREE TO DROP US A LINE.