Protect your kids from identity theft

Cyber fraudsters, sadly, have provided a new meaning to the axiom ‘catch them young’. Increasingly, children are becoming victims to identity thefts and online frauds. Egged on by a spurt in digital commerce, online learning and the usage of the social media, children are being increasingly exposed to these threats. To put it in perspective, research firm Javelin Strategy states that child identity frauds cost US families near $1 billion and affects one out of 50 children every year.

Children are specifically targeted by scam artists owing to their age, impressionable frame of mind and clean financial records that aid evasion of fraud detection for a longer span of time. The same research report says that detection and resolution of such child identity frauds takes longer time and is more expensive. Hence it is not surprising that “National Child Identity Theft Awareness Day”, promoted by Experian, is being celebrated on 01st of September every year.

Identity of children are stolen to create synthetic identities to perpetuate further frauds in addition to the usual misuses like opening bank accounts, obtaining credit cards through dubious means and availing social benefits. No doubt that it is a daunting task for parents and guardians to monitor the online activities of their children, to ensure their cyber well-being and protect them from any harm.

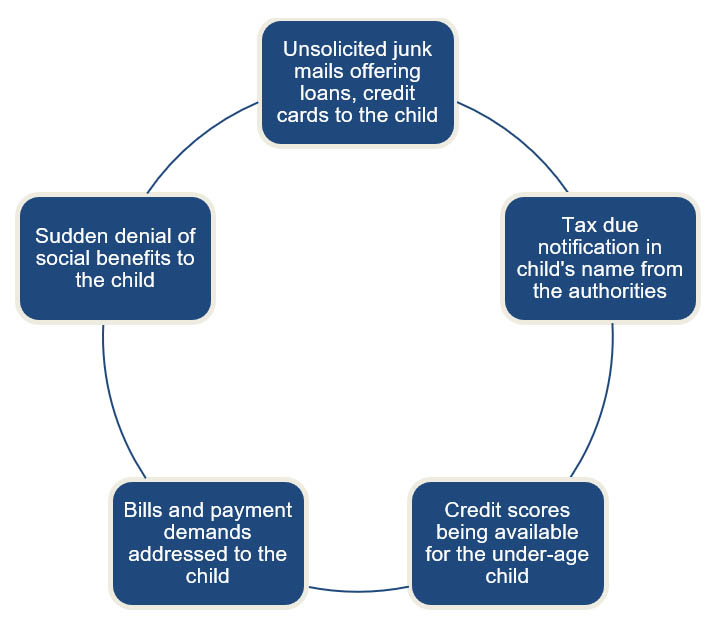

Here are a few tell-tale signs of child identity theft:

Considering the pervasive nature of child identity frauds, it is imperative that the parents and guardians stay ahead of the curve, and ensure the online safety of their children. A few best practices, detailed below, will go a long way in protecting children from identity thefts and such.

- Safeguarding personally identifiable information (PII) like full name, national ID, passport number and email address of the child. This entails secure storage of both physical and electronic records pertaining to the child, apart from ensuring non-divulgence of such information in public domain.

- Prudent usage of social media and refraining from posting too much of personal information about your kids like their names, grades, school name, hobbies and favourites. Every nugget of information is valuable and a potential key to fraudsters.

- Constant monitoring of online activities in addition to inculcating a sense of cyber security and digital discipline in children. Restricting the usage of social media – both in terms of the platforms accessed and the duration spent on these platforms, is advisable.

- Device security isof paramount importance in the wake of increased vulnerabilities and misuse of data. Securing mobile phones, tablets and computers with up-to-date anti-virus software, latest security applications, strong passwords / biometrics-based authentication mechanisms is strongly recommended.

- Secure ways of data disposal should always be followed. Proper protocols should be adhered to while disposing off physical or electronic documents containing sensitive personal information. Shredding of documents and using secure data wiping software are some of the ways to ensure prevention of data falling into wrong hands.

- Locking the child’s credit report will helpprevent fraudsters exploiting a child’s identity to avail loans, credit cards and commit financial crimes

- Investing in a robust identity protection service is one of the most reliable ways to ensure that a child’s identity is secured and constantly monitored. Identity protection services offer wholesome protection to the entire family against a range of online financial and social threats and thefts.

Children are perceived as easy targets because of their vulnerability and also due to the fact that frauds committed using a child’s identity take longer time to even detect or uncover. It is hence imperative on the part of parents and guardians to safeguard the children against perpetrators of such crimes. Here is where identity protection services play a key role.

Be it monitoring of bank and credit card accounts, providing alerts based on national IDs, reporting on suspicious activities or credit monitoring, a robust identity protection service takes care of everything. Plans offered by these service providers offer holistic coverage for the entire family including children, thereby taking a big pressure off the parents and guardians. They also offer customized packages that help customers to pick feature(s) of their choice.

Digid is a thought leader in customer on-boarding and identity management space. With an alarming increase in cybercrimes across business domains and impacting all strata of the society including children, it is important for us to harness technology to safeguard ourselves from these attacks. Powered by AI technology, Digid ensures comprehensive protection from identity thefts to businesses and their customers in a seamless and efficient way.

FEEL FREE TO DROP US A LINE.